Dark light macro sample line, 8 popular mobile phones that focus on taking pictures

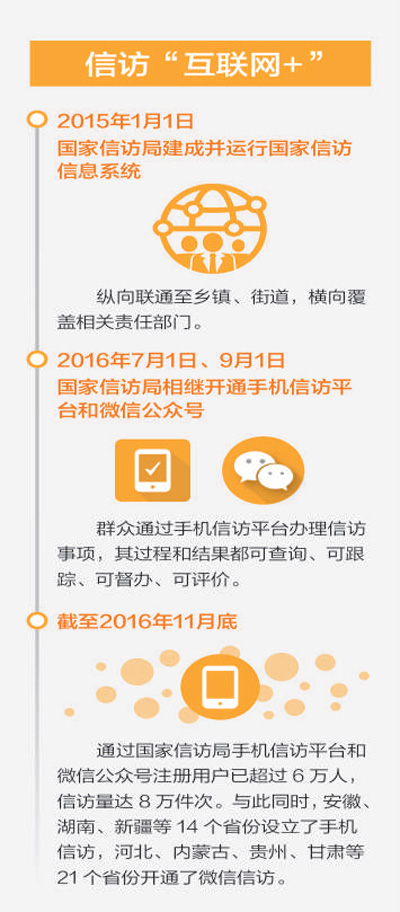

Now in July, most schools have been closed, and many parents will take time to spend more time with their children. At the same time, many parents will take their children to travel with them during the summer vacation, so they will record every wonderful moment during the travel process, especially the smiling face of the child. In addition, many friends no longer like to bring digital cameras, but are used to using themcell phoneTo shoot. Many mobile phones on the market today are very close in terms of hardware configuration, and more still differentiate in terms of photography to attract users, including things likeSamsung Galaxy K ZoomCombining 10x light change with various smart camera functions will bring users better performance. Here are eight excellent machines that currently focus on camera functions.

Dark light macro sample line, 8 popular mobile phones that focus on taking pictures

SamsungGALAXY K Zoom

SamsungGALAXY K ZoomIt is an excellent camera phone. The machine has been greatly upgraded in terms of performance compared to the previous generation of products. In terms of photography, the machine is even more equipped with20.70 million pixelsThe lens, plus 10x optical zoom function, is better than many digital cameras. In addition, the machine has 28 camera modes to choose from, such as manual, automatic, macro, food, fireworks, silhouette, etc., which is enough to deal with various daily shooting situations. The smart selfie function can better ensure that you can take excellent photos with the rear lens.

Pictured, SamsungGALAXY K Zoom

SamsungGALAXY K ZoomThe front uses a 4.8-inch Super AMOLED display with a resolution of 1280X720 pixels, and the display effect is still very delicate. In the core, there is a built-in 1.7GHz Samsung Exynos 5 Octa 5260 six-core processor and a memory combination of 2GB RAM + 8GB ROM, which can run Android 4.4 system smoothly. In addition, there is an ultra-clear lens with 20.70 million pixels supporting 10x optical zoom on the back of the fuselage with xenon flash, etc., which is very good for taking pictures.

Pictured, SamsungGALAXY K Zoom

Pictured, SamsungGALAXY K Zoom

Pictured, SamsungGALAXY K Zoom

Editor’s comment:

SamsungGALAXY K ZoomAs a mobile phone with the main camera function, the machine is equally excellent in hardware configuration. The Samsung six-core processor is equipped with 2GB of memory, and the whole machine runs very smoothly. And in the 20.70 million pixel lens configuration, the processing of photos is also very eye-catching. In addition, the machine also has settings equipped with flash, filters, voice control and other basic functions, allowing users to be smarter and more efficient in terms of functional experience.

Samsung Galaxy K Zoom C1116 (licensed)

[Reference price] 3699 yuan

[Sales Merchant] JD.com

[Related Links] http://item.jd.com/1138438.html

Nokia 1520

Nokia has always had an advantage in taking pictures. With the improvement of hardware configuration, Nokia’s performance in taking pictures is becoming more and more eye-catching. Nokia 1520 is equipped with a 20 million pixel lens, which is also guaranteedcell phoneThe "Nokia Smart Shot" app integrates the best photo, erasing moving objects, selecting smiley faces and sports lenses, making taking pictures more playable. In addition, the "Nokia Professional Shoot" feature is very practical for users with a certain level of photography.

Pictured, Nokia 1520

Nokia 1520 front with a piece6 inchesCapacitive touch screen, with a resolution of 1920X1080 pixels FHD level, the display effect is outstanding. On the back of the fuselage, there is a 20 million pixel main lens with enhanced photosensitive elements and support for OIS optical image stabilization function, including dual LED fill light, with more rich professional camera settings and modes. In addition, the core of the machine uses a 2.2GHz Snapdragon 800 series quad-core processor, as well as a combination of 2GB RAM + 32GB ROM memory, which can perfectly run the new Windows Phone 8 GDR3 version system.

Editor’s comment:

Nokia 1520 in addition to excellent performance in photography, the performance of the whole machine is also excellent. The machine is equipped with a 6-inch large high definition screen, Snapdragon 800 processor and 2GB random access memory, which is not only excellent in display, but also the current flagship level in performance. The machine is equipped with Windows Phone 8 operating system, the whole machine runs more smoothly. In addition, the body of the machine still uses a colorful plastic material design, which looks very fashionable and atmospheric.

Nokia 1520 (licensed)

[Promotional Merchant]Z.CN ![]()

SonyXperia Z2

SonyXperia Z2It’s Sony’s latest flagship.cell phoneThe machine is currently equipped with the best Sony in terms of photography20.70 million pixelsIn addition, the advanced automatic function of the machine can also automatically identify the current scene and switch to the most suitable camera mode; fast continuous shooting is to capture 61 photos in an instant, allowing users to choose the best one to save, which is very practical for users, and can further improve the camera speed.

Pictured, SonyXperia Z2

SonyXperia Z2The front uses a 5.2-inch 1080P display screen, and uses Sony TRILUMINOS mobile display technology and X-Reality Xunrui image processing engine mobile version, the display effect will be more realistic. In the core, the machine is also equipped with a 2.3GHz Snapdragon 801 quad-core processor, and a memory combination of 3GB RAM + 16GB ROM, which can run Android 4.4 system perfectly. In terms of photography, it is equipped with a nearly perfect 20.70 million pixel Sony G lens and BIONZ image processor assistance, supporting 4K video recording function.

Editor’s comment:

SonyXperia Z2As Sony’s latest flagship mobile phone, the machine is equipped with the current top-level configuration in terms of hardware, and the whole machine runs very well. And the 20.70 million pixel G lens configured in terms of photography is also the standard of Sony’s flagship machine, and this upgrade is not in terms of lens but in terms of camera function. New panoramic shooting and background defocus functions are added, allowing users to have a better camera experience and making the phone more playable.

Sony MobileXperia Z2(Licensed goods)

[Promotional Merchant]Z.CN ![]()

HTC One M8It is a flagship launched by HTC with dual rear lensescell phoneThe machine still uses an all-metal body design, and the metal coverage area of the whole machine is further improved, which looks more tough. In addition, the machine is equipped with a rear dual-lens design in terms of photography, one of which is an UltraPixel camera with 4 million pixels, and the other is a depth-of-field lens mainly used to record spatial information and depth of field. It can realize the function of taking pictures first and then focusing, and can also take photos with 3D effects.

The picture shows HTC One M8

HTC One M8loaded5.0 inchesCapacitive multi-touch screen with a resolution of 1920X1080 pixels FHD level, the display effect is good. In terms of hardware, the machine uses a Snapdragon 801 quad-core processor with a main frequency of 2.5GHz, and a memory combination of 2GB RAM + 16GB ROM, running the new Android 4.4 operating system. In addition, there is an Ultrapixels ultimate pixel concept 4 million pixel lens on the back of the fuselage, and a depth of field camera, which can take 3D photos.

Editor’s comment:

HTC One M8It is HTC’s latest flagship mobile phone. Compared with the previous generation of products, the whole machine has been improved very significantly, especially the machine is equipped with dual rear lenses in taking pictures, including one used to record depth of field data. Coupled with excellent hardware configuration, photos can be processed in a variety of ways on the mobile phone, which is very convenient. In addition, the machine can currently support 4G mode, allowing users to have an extremely fast network experience.

HTC ONE M8W (licensed)

[Reference price] 3999 yuan

[Sales Merchant] JD.com

[Related Links] http://item.jd.com/1094932.html

OPPO N1 miniIt is an outstanding one of OPPO’s photography strength.cell phoneThe machine is a mini version of the previous OPPO N1, the body and hardware configuration have been adjusted, but in terms of photography, the machine is still equipped with a single lens design of 13 million pixels, and also supports the flip function. But the machine is equipped withSonyThe IMX214 second-generation stacked camera has a better lens than the OPPO N1, and it is also very comfortable to operate with one hand due to the smaller body.

The picture shows OPPO N1 mini

OPPO N1 miniAdopted on the front of the fuselage5.0 inchesIPS primary color hard screen, the resolution reaches 1280×720 pixels, the screen pixel density is up to 294ppi, and the display effect is very good. In terms of core hardware configuration, the machine is equipped with a Qualcomm Snapdragon Snapdragon MSM8928 quad-core processor with a main frequency of 1.63GHz, and a memory combination of 2GB RAM + 16GB ROM. Smooth operation of Color OS based on Android 4.2 system. In addition, in terms of the best photography, the machine is equipped with 13 million pixel lens, the lens can be flipped, and the selfie effect is equally excellent.

The picture shows OPPO N1 mini

The picture shows OPPO N1 mini

The picture shows OPPO N1 mini

Editor’s comment:

OPPO N1 miniThe camera strength is very good, especially the single lens design that can be flipped. In addition, the machine is equipped with time-lapse photography, voice photography, touch screen photography and other functions, and the ultimate beauty function is equipped to enhance the selfie effect of the machine. In addition, the machine is equipped with ultra-high definition image quality function, which can integrate photos of 24 million pixels. In other aspects, the machine also supports 4G network. The performance of the whole machine is also very good.

OPPO N1 mini(Licensed goods)

[Promotional Merchant]Z.CN ![]()

vivo XShotIt is a new machine with a new camera function. There are currently two versions of the machine on sale, including the flagship version and the elite version. The difference between the two is mainly in terms of hardware configuration. In terms of lenses vivo XShotAlso equipped with 13 million pixelsSonyThe second-generation stacked camera, in addition to the configuration of the rear dual color temperature LED flash; the machine is equipped with a wide-angle lens of 8 million pixels in the front lens, and the selfie ability is also excellent.

The picture shows vivo. XShot

vivo XShotEquipped with a 5.2-inch IPS touch screen with a resolution of 1920×1080 pixels. The photo is vivo. XShotThe biggest attraction is that its main camera is a 13 million pixel Sony stack camera with an oversized f/1.8 aperture and dual color temperature dual LED flash. Its front-facing camera is a 8 million pixel camera with an oversized wide angle of 84 degrees, an aperture value of f/2.0, and a full spectrum fill light. On the hardware side, vivo XShotEquipped with Qualcomm Snapdragon 801 series quad-core processors, the flagship version is 2.5GHz/578MHz, while the elite version is 2.3GHz/450MHz. The flagship version uses a combination of 3GB RAM and 32GB ROM, while the elite version uses a combination of 2GB RAM and 16GB ROM. Both versions support expansion cards up to 128GB.

Editor’s comment:

Vivo mobile phoneTaking the fashionable route, the machine also adopts an integrated fuselage design, the thickness of the whole machine is only 7.99 mm, which is very light and thin. In addition, the machine is equipped with the most flagship Snapdragon 801 processor in terms of hardware configuration, and the performance of the whole machine is very good. And the machine is equipped with a 13 million pixel lens in terms of photography, and adopts an F1.8 super aperture, which increases the light intake by 50% compared with the F2.2 aperture, and the camera effect is more eye-catching.

vivo XShotElite Edition (licensed)

[Sales price] 2998 yuan

[Purchase address] vivo official website mall

[Contact number] 400 678 9688

The Nubia X6 is the flagship of the Nubia brandcell phoneThe machine is equipped with front and rear dual 13 million pixel lenses, and is equipped with dual LED fill light on the back of the fuselage. In addition, the machine also has three types of camera modes: automatic, professional, and fun. Among them, the automatic mode is the most basic camera mode, and the professional mode requires a certain camera foundation, including compass level, focus point, etc., while the fun mode is equipped with passer-by removal, motion track, star track, etc., which is very playable.

Pictured, Nubia X6

The Nubia X6 is equipped with a 6.4 inchesSharp CGS screen, with a resolution of 1920X1080 pixels FHD level, the display effect is extremely amazing. In terms of core, the machine has a built-in Snapdragon 801 MSM8974AB quad-core processor with a main frequency of 2.3GHz, and a memory combination of 2GB RAM + 32GB ROM. It can smoothly run the Nubia UI 2.0 interface based on Android 4.3 version, and is equipped with a 4250mAh capacity battery. In addition, there is a 13 million pixel professional lens that supports OIS optical image stabilization on the back of the fuselage, and its corresponding 13 million pixel front lens that supports AF function.

Editor’s comment:

Nubia X6 is equipped with a high definition large screen design, which is very eye-catching in entertainment. In addition, the machine also has the most powerful Snapdragon 801 processor at present, and the 32GB large storage design can fully meet the user’s storage needs. In terms of taking pictures, the machine is equipped with a dual 13 million lens design, which is very good in both rear shooting and selfie. This lens is also rare at present. In addition, the machine also supports 3G full Netcom network.

4G version Nubia X6 (licensed)

[Product price] 2999 yuan

[Sales Merchant] JD.com

[Related Links] http://item.jd.com/1089822.html

HuaweiAscend P7It is a new flagship released by Huawei this year.cell phoneIn comparison to this machineHUAWEI P6The improvement is very obvious, especially in terms of photography. The machine is equipped with a 13 million pixel rear lens and an F2.0 super aperture; while the front lens is equipped with a 8 million pixel lens and supports ten-level beauty functions, and the selfie effect is better. In addition, the machine is equipped with double-sided gorilla glass on the fuselage, and the fuselage performs better in scratch resistance and wear resistance.

Pictured, HuaweiAscend P7

HuaweiAscend P7Use a piece on the front5 inchesThe full high definition display produced by JDI has a resolution of 1920X1080 pixels FHD level, and the display effect is very delicate. The core has a built-in 1.8GHz HiSilicon Kirin 910T quad-core processor and a memory combination of 2GB RAM + 16GB ROM, which runs smoothly based on the Emotion UI 2.3 user interface of Android 4.4 system. There is a 13 million pixel on the back of the fuselageSonySuper lens, and its corresponding 8 million pixel ultra-wide-angle front lens.

Editor’s comment:

HuaweiAscend P7It is a very excellent flagship mobile phone. The hardware configuration of the machine is still equipped with Huawei’s own HiSilicon quad-core processor, and the whole machine runs very smoothly without cards. The body design of the machine still continues the design concept of ultra-thin body, the thickness of the whole body is only 6.5mm, and it is equipped with double-sided gorilla glass. In addition, the three versions of the machine can support 4G network, which can maintain a high-speed network experience for users in real time.

HuaweiAscend P7(Licensed goods)

[Reference price] 2888 yuan

[Sales Merchant] JD.com

[Related Links] http://item.jd.com/1124089.html

Summarize:

The above-mentioned mobile phones are currently very good at taking pictures, especiallySamsung Galaxy K ZoomNot only is the camera effect comparable to a digital camera, but the design of the fuselage is also very similar. AndNubia X6It even claims to be able to shoot star trails, and its photography strength is very outstanding. AndOPPO N1 miniThe fuselage is very suitable for one-handed operation, and the camera power is better than the previous N1. In addition, the Nokia 1520,HTC One M8Sony Z2 are the flagship mobile phones of these brands, with the same powerful shooting strength. Friends who need to buy mobile phones recently can consider the above models.

Now in July, most schools have been closed, and many parents will take time to spend more time with their children. At the same time, many parents will take their children on trips during the summer vacation, so they will record every wonderful moment during the trip, especially the smiling face of the child. In addition, many friends no longer like to bring digital cameras, but are used to using mobile phones to shoot.

Pang Chao