Recently, the National Bureau of Statistics released data. In April, the national consumer price rose by 2.5% year-on-year. Among them, the price of fresh fruit rose by 11.9%, which affected the CPI by about 0.22%.

According to media reports, the CPI data of 31 provinces in April have also been released one after another. Don’t look at the classification, there are 13 provinces with a year-on-year increase in fresh fruits, and 18 provinces with an increase of over 10%.

Why is the price of fruit "rising" recently? When will the price stabilize in the future?

On May 23, CCTV Financial Review invitedGuo Liyan, a researcher at the Market Institute of China Macroeconomic Research Institute, andWang Guan, a commentator of Yangguang Finance and Economics, was a guest in the studio.

Why is the fruit "rising"?

Guo Liyan: The seasonal supply gap of fresh fruit is bigger than in previous years.

Guo Liyan, a researcher at the Market Institute of China Macroeconomic Research Institute: The seasonal supply gap of fresh fruit is larger than in previous years, and there are several factors. The first is from 2018 to 2019.Disastrous weather occurred in different degrees in the southern and northern fruit producing areas during the growing period, and it is a gap period in the fruit market at present.

In addition,At the beginning of this year, there was a cold spring, and the handling cost and labor cost in some parts of the south also increased during the rain. Coupled with the increase in transportation costs, the price of fresh fruit rose.

Crown: "Yan value economy" has become a price pusher

Wang Guan, commentator of Yangguang Finance and Economics: From another perspective, I noticed that the number of fruits imported from Beijing Xinfadi is increasing, and the price of fruits is also rising.The impact of the increase in the proportion of high-end fruits such as foreign imports and organic fruits.

Consumers’ demand for "fine fruits" is increasing, which leads to the continuous improvement of the quality and grade of fruits. In addition, with the development of cities, some traditional farmers’ markets gradually fade out.The sales channels of new fruit specialty stores or comprehensive supermarkets, and the cost of property are increasing. These factors have promoted the price of fruit to a certain extent.

When will "low-key fruit" return?

News link:

Liu Aihua, spokesperson of the National Bureau of Statistics, said recently that the price of fresh fruit is affected by seasonal factors of extreme weather, and the seasonal short-term impact is not sustainable.The rise in the price of fresh fruit will not last at a high level.

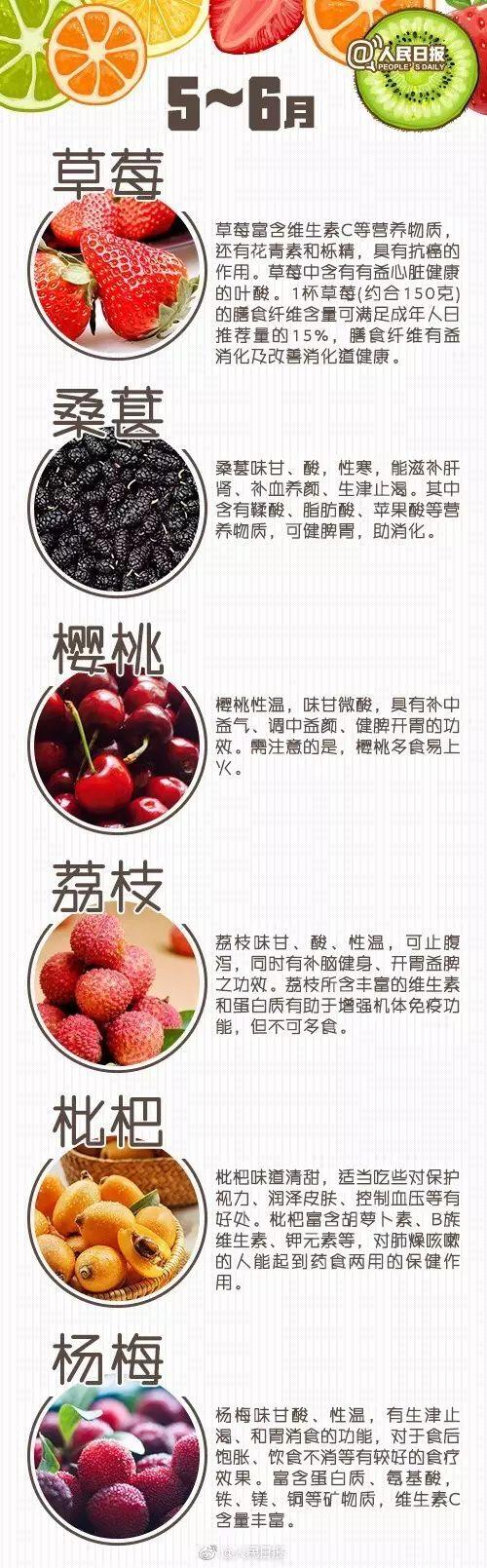

Guo Liyan, a researcher at the Market Research Institute of China Macroeconomic Research Institute: From June to August, summer fruits began to be listed in batches, and melons such as watermelons and cantaloupes were gradually listed, which would lower the whole fruit market price.

By September, as new apples mature and enter the market this year, the price of fresh fruit will be stabilized, and with the gradual increase of supply, the price of fresh fruit will gradually stabilize.

Crown: E-commerce giants actively enter the market, price subsidies attract traffic

Wang Guan, commentator of Yangguang Finance: Now online shopping has become the choice of many consumers. Nowadays, e-commerce has entered an era of digging deep into stocks, and various shopping apps are attracting everyone’s attention.

Recently, everyone will see that at least 3 to 4 home appliance manufacturers have entered fruit producing areas, such as litchi producing areas, hoping to compete for traffic through the docking of e-commerce and fruit farmers. Consumers will download the APP and get discounts when buying fruits.These promotional measures are aimed at targeting the market and competing for users, but they also bring certain benefits to consumers.

Guo Liyan: Smooth supply channels, fruit prices will fall seasonally, and the price base will be solid.

Guo Liyan, a researcher at the Market Research Institute of China Macroeconomic Research Institute, said: People’s consumption is upgrading, and the quality of consumption is also upgrading. Now, we choose the best from the fruit seed industry.

I think subtraction should be done as far as possible around fruit production, storage, circulation, retail and distribution, so that it can reach the people through simple links and reduce costs. In addition, we should improve the quality of service supply.

On the other hand, around the supply, we can look at it from a broader perspective. Some good high-end fruits imported from abroad, such as fruits from Southeast Asia and other places, can be matched out of season, and some fruits can also expand their stocks. In the case of low stocks, we can stabilize the price of fresh fruits by expanding overseas supply, improving stocks and unblocking channels, which provides strong support for food prices. I think there is a solid foundation for stabilizing prices.

Crown: price increase and slow sales coexist. Agricultural modernization needs to be accelerated

Wang Guan, commentator of Yangguang Finance: Recently, fruit prices are rising, but this year,In some places, fruits are also unsalable.

Because the freshness of fruits is relatively strong, the sales channels are not smooth for a short time, which reflects to some extent that there is a relatively high room for improvement in order agriculture, and our agricultural modernization needs to be accelerated in the future.