Wang Jianlin’s big move! The class A share movie theater faucet may change hands, and the receiver is "post-80s"!

The control of cinema leader Wanda Film (002739) may change.

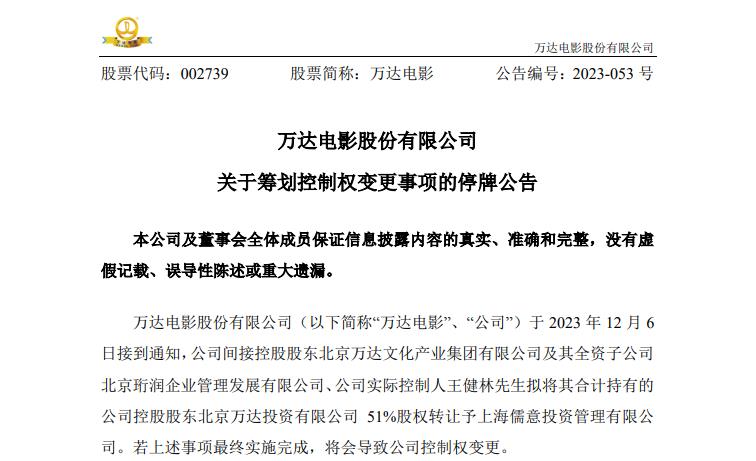

On December 6, Wanda Film announced that the company’s indirect controlling shareholder, Beijing Wanda Cultural Industry Group Co., Ltd., and its wholly-owned subsidiary, Beijing Hengrun Enterprise Management Development Co., Ltd., and the company’s actual controller, Wang Jianlin, intend to transfer their combined 51% equity in Beijing Wanda Investment Co., Ltd. (hereinafter referred to as "Wanda Investment") to Shanghai Ruyi Investment Management Co., Ltd. (hereinafter referred to as "Shanghai Ruyi Investment").

Wanda Investment is the controlling shareholder of Wanda Film. Wanda Film said that if the above matters are finally implemented, it will lead to a change of control of the company.

In view of the uncertainties in the above matters, Wanda Film will suspend trading from the opening of the market on December 6, 2023 (Wednesday), and it is expected that the suspension time will not exceed 2 trading days. On the morning of December 6, the Shenzhen Stock Exchange has announced that Wanda Film plans to plan a change of control, and the stock will be temporarily suspended from the opening of the market on December 6. Trading will resume after the company discloses relevant announcements through designated media.

Shares have been transferred several times this year

Since the beginning of this year, Wanda Film has undergone several equity changes. According to the 2022 annual report, Wanda Investment directly holds 38.99% of Wanda Film’s shares.

In March, Wanda Investment’s concerted action, Wanda Culture Group, reduced its holdings of Wanda Film 43.5653 million shares through the block trade system, accounting for 1.999% of the company’s total share capital. In April, Wanda Investment announced a reduction plan to reduce its holdings of Wanda Film shares by no more than 65.38 million shares, accounting for 3% of the company’s total share capital.

Entering the second half of the year, Wanda Film’s equity transfer accelerated.

On July 10, Wanda Investment signed a share transfer agreement with Lu Lili, agreeing that Wanda Investment will transfer its holding of Wanda Film 180 million shares to Lu Lili, accounting for 8.26% of the company’s total share capital.

On July 17, Wanda Investment and its acting party, Xinxian Rongzhi Industrial Management Consulting Center (Limited Partnership) (hereinafter referred to as "Xinxian Rongzhi"), signed the "Share Transfer Agreement", and Wanda Investment transferred its holding of Wanda Film 177 million shares to Xinxian Rongzhi, accounting for 8.14% of the company’s total share capital.

After the transfer of the above agreement is completed, Wanda Investment holds 436 million shares of Wanda Film, with a shareholding ratio of 20%. Wanda Investment and its concerted actors together hold 673 million shares of Wanda Film, accounting for 30.9% of the company’s total share capital.

Before the proposed transfer of 51% of Wanda’s investment, on July 20, 2023, Wanda Culture Group had signed an Equity Transfer Agreement with Shanghai Ruyi Film and Television Production Co., Ltd. (hereinafter referred to as "Shanghai Ruyi Film and Television").

Wanda Cultural Group intends to transfer its 49% stake in Wanda Investment to Shanghai Ruyi Film and Television. After the transfer is completed, Wanda Cultural Group indirectly holds 222 million shares of Wanda Film through Wanda Investment, with a shareholding ratio of 10.2%. Wanda Cultural Group and its concerted actors directly and indirectly hold 460 million shares of Wanda Film, with a shareholding ratio of 21.1%.

According to Qichacha, as of December 6, Shanghai Ruyi Film and Television held a 49% stake in Wanda Investment, Beijing Hengrun Enterprise Management Development Co., Ltd. held 29.8%, Wanda Culture Group held 20%, and Wang Jianlin personally held 1.2%.

Wanda Film Industry Leader

Wanda Film has long been a leader in domestic theaters.

Lighthouse data show that since 2023, the national film box office has reached 51.45 billion yuan, of which Wanda cinema box office 8.94 billion yuan, far more than the second 4.481 billion yuan. Wanda cinema attendance 190 million, with an average of 15 people per game, all in a leading position in the industry.

Wanda Film also ranks first in the country all year round. Wanda Film’s cinemas and screens rank first in the industry. Since 2023, 9 of the top 30 cinemas in the country have been Wanda Studios.

According to the third quarter report of 2023, from January to September this year, Wanda Film’s domestic theaters achieved a box office of 6.22 billion yuan (excluding service fees), an increase of 67.6% year-on-year and 5.2% over the same period in 2019; the number of people watching movies 150 million, an increase of 68.7% year-on-year, an increase of 3.7% over the same period in 2019.

As of September 30, 2023, Wanda Film had 877 open theaters and 7,338 screens in China, including 709 directly-operated theaters, 6,159 screens, 168 light-asset theaters, and 1,179 screens. The company’s cumulative market share in the first three quarters was 16.5%.

"Post-80s" Colliming takes over

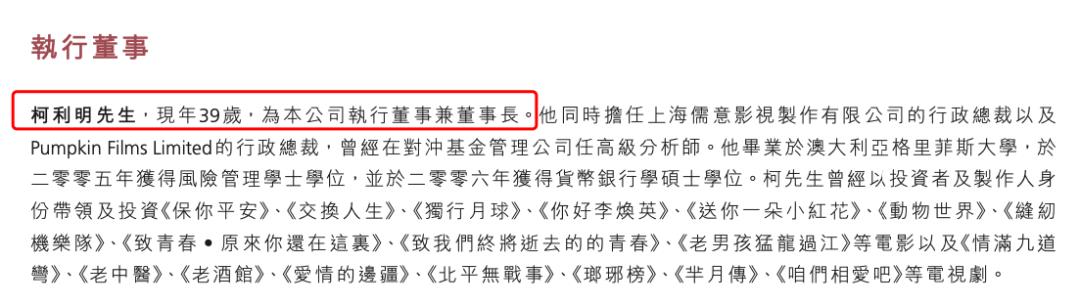

Shanghai Ruyi Investment, which plans to take over 51% of Wanda’s investment, and Shanghai Ruyi Film and Television, which previously took over 49% of Wanda’s investment, are both controlled by Ke Liming.

Shanghai Ruyi Film and Television is a subsidiary of China Ruyi Holdings Co., Ltd. (hereinafter referred to as "China Ruyi" 00136.HK), a Hong Kong-listed company. China Ruyi owns 100% of Shanghai Ruyi Film and Television. Tencent is one of the major shareholders of China Ruyi.

On December 6, Chinese Confucianism rose more than 9% in intraday trading, and its market value rose to HK $22 billion.

"Confucianism" can be called a dark horse in the film industry in recent years. According to Lighthouse data, Shanghai Confucianism Film and Television has produced 43 works in recent years, with a total box office of 17.677 billion yuan and a total box office of 7.434 billion yuan. These include well-known works such as "Hello, Li Huanying", "Vanished Her", "Walking Alone on the Moon" and "Send You a Little Red Flower".

Ke Liming’s other main body, Beijing Ruyi Xinxin Film Investment Co., Ltd., has also produced 5 works, with a total box office of 1.438 billion yuan, including "To the Youth We Will Eventually Die", "Small Times 4", "Old Boy’s Raptor Crossing the River" and other well-known works.

According to the financial report, Colliming is a post-80s generation, now 39 years old.He worked as a senior analyst at a hedge fund management company. He graduated from Griffith University in Australia with a bachelor’s degree in risk management in 2005 and a master’s degree in money and banking in 2006.

According to the delisted Shanghai Fukong previously disclosed, Ke Liming himself led some project personnel to join Huashi Film and Television Investment (Beijing) Co., Ltd. in March 2011. Ke Liming served as the general manager of Huashi Film and Television and filmed film and television works within the main body of Huashi Film and Television.

It was during this period that Ke Liming and his team participated in the planning and production of the movie "To Youth", the TV series "The Woman of the Swordsman Family", and the movie "Tiny Times 1 and 2" and many other works. In December 2012, Ke Liming left China Vision Film and returned to Ruyi Film as the general manager. Since then, Ruyi Film’s business has developed rapidly. It began to plan the TV series "No War in Peking" and the movie "Old Boy’s Raptor Crossing the River" that year, and achieved good responses.