"Is Xiaomi an Internet company?"

Although Lei Jun preached his own answer as early as the beginning of his business, Xiaomi has never escaped the self-torture caused by the above topics for the next eight years.

"Xiaomi is an Internet company that must focus on mobile phones, intelligent hardware and IoT platforms." In Xiaomi’s IPO prospectus, as many as three attributes were attached before the definition of "Internet company". The latter two are the new business opportunities that Xiaomi has developed for himself after experiencing the "U-shaped" trough in 2015.

Lei Jun once felt that this new version of "Millet Genesis" should push its valuation to 100 billion dollars. But at least when it went public in July this year, the capital market only recognized 45 billion dollars-less than half of it. At the end of October, the company’s market value once fell to about 32.5 billion dollars.

Xiaomi urgently needs to prove to investors that he has enough imagination and considerable profit margin in commercial liquidity.

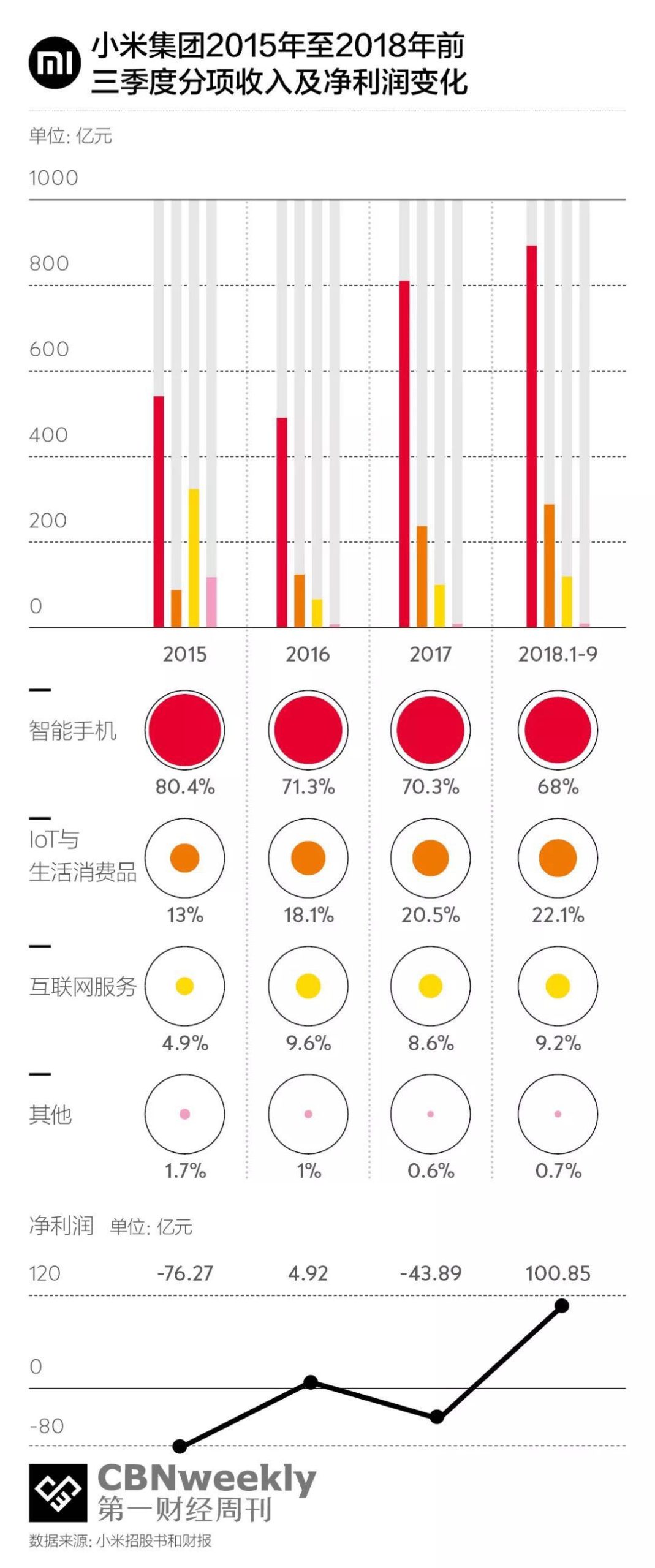

On November 19, 133 days after the completion of the listing on the Hong Kong Stock Exchange on July 9, Xiaomi Group announced its financial report for the third quarter of 2018. Although its mobile phone revenue still accounts for 68%, it has continued to decline compared with 70.30% in 2017-in 2015, this figure was still 80.4%.

While the proportion of mobile phone revenue is shrinking, the revenue structure is growing from "Internet service" and "Internet of Things (IoT) and consumer products". Their contributions to Xiaomi’s total revenue have reached 9.2% and 22.1% respectively.

In the past few years, due to the excessive number of MIUI systems and the premature implementation of the important mission of "realizing Internet services", the engineers of MIUI team had to directly face the performance tasks split to each of them, and the contradiction between user experience and realization once became very sharp.

Fortunately, the hardware with non-"Mijia" label produced by more than 200 eco-chain companies invested by Xiaomi, especially sold through Xiaomi’s retail channels, is actively helping Xiaomi to unload some of the liquidity pressure on MIUI at least in the short and medium term-they don’t need to strictly abide by the rule of "the comprehensive net profit rate of hardware should not exceed 5%" set by Lei Jun, but are only required to be significantly lower than the profit rate of similar products in the same industry, as long as the price is competitive, the product concept and.

There is a consensus in the industry that the smart phone market has entered the stock market, and the smart hardware launched by Xiaomi Eco-chain Company can not only contribute considerable hardware revenue, but also continuously provide the "Internet users" that Xiaomi craves, and they can even leap over the Android system to which MIUI belongs, winning a large number of iOS users for Xiaomi. The heavy responsibility of continuously expanding the sales of "IoT and consumer products" was handed over to Xiaomi’s so-called new retail strategy.

However, in the face of increasingly complex business structure, this young company continues to increase its management challenges. The distance between the Internet ideal preached by Lei Jun and the realization reality faced by Xiaomi seems to be constantly being lengthened.

# MIUI: realize, realize, realize #

Just two weeks after Xiaomi announced the most important structural adjustment in the company’s history, "rice noodle" Zhang Yong left Xiaomi. To be precise, he made this decision after "powdering".

He joined Xiaomi in early 2016, which was the darkest moment in the company’s eight-year history. But Zhang Yong had a very optimistic judgment at that time: it was an opportunity for an excellent company to "bargain-hunting".

During that time, Xiaomi was at the end of a high-level personnel struggle. As the end of this struggle, in late May 2016, Lei Jun issued an internal letter about the appointment and dismissal of personnel, saying that "Zhou Guangping, co-founder and vice president of Xiaomi Technology, will be the chief scientist of Xiaomi". Zhou Guangping’s new position is described as "being responsible for the research in the frontier field of mobile phone technology", which is quite modest. In the past, the two business lines of Xiaomi mobile phone research and development and supply chain, which he led for many years, were changed to Lei Jun himself.

Zhou Guangping’s downfall stems from the "Xiaomi 5 Incident" which began to ferment in the spring of 2015. Xiaomi 5 is the 5th generation mobile phone of Xiaomi. It was originally planned to be launched in June 2015, but it was not until February of the following year that the mobile phone was shipped from the factory. The reason is that Guo Jun, vice president of Xiaomi’s mobile phone supply chain, who reported to Zhou Guangping, almost offended Xiaomi’s suppliers. In the whole half year, there were 10 mobile phones on Xiaomi Mall, but only one or two were available. This is the starting point for Xiaomi to fall into a series of bad luck in the absolute core business of mobile phones.

"Many people didn’t believe that (the company) would turn over from (Xiaomi) 5." Zhang Yong told China Business News. But what he didn’t expect was that Xiaomi’s turn-over journey, which took more than two years, eventually became his own "powder removal" journey.

Being in Xiaomi Company, Zhang Yongcai gradually realized that the "ideal" and "model innovation" that Lei Jun preached every day had experienced layer-by-layer transmission, and the realistic pressure that he, a grass-roots product manager in MIUI department, had to face every day could have turned into an irreconcilable contradiction.

The two system versions—MIUI 7 and MIUI 8 released in August 2015 and June 2016—are both called "ADUI", which means that it is an advertising system, not a user interaction system.

These two systems will not only force advertisements to be pushed without customization by users, but also recommend other related or unrelated new applications in the form of buoys when users open some applications. The effect is just like the kind of advertisement floating window on many Internet pages. If you want to close it, you may not even find the entrance. Some users feel that their mobile phones have become like "warm babies", and it is suspected that there is something wrong with the battery. In fact, the system loads too much content.

Outside, people began to label Xiaomi as a "giant baby company", which means to grow hands and feet first, then brains, and to form values because of its rapid growth. Didi Chuxing and today’s headlines were later considered as this type of company.

This word may not be appropriate for Lei Jun.. He is nearly 50 years old and has successively listed four companies. Those companies can be called excellent, not excellent. He has said on many occasions that Xiaomi was the last company he founded in his lifetime. Even if it is not out of the social ideal of creating a national brand and promoting a new round of industrial revolution, he badly needs a company worth 100 billion dollars to prove himself.

The problem Lei Jun faces is not that the company has no values, but that his expectations are so high that he will unconsciously create luck and rationalize some radical practices when he can’t reach them. "He once said at the press conference that we sell mobile phones at such a low price, and users are definitely willing to let us make some money on the system. If one day we are going out of business, there will be rice noodles to donate to us." Zhang Yong said.

MIUI’s advertising space has been increasing under Lei Jun’s indifference. A person from Xiaomi’s public relations department told CBN Weekly that the company has never formulated a specific KPI for the MIUI department, let alone linked the liquidity to the salary of the employees in the department. However, Zhang Yong said that those numbers will be written into OKR(Objectives and Key Results) and become a kind of implicit encouragement. "The so-called OKR can actually be understood as KPI, and sometimes the bosses will blurt out’ KPI’ when they are in a hurry …"

"The mission of engineers is no longer just to make a pure product, let alone have any energy to support them to polish a successful application that jumps out of Xiaomi system in terms of user value and is enough to serve the users of the whole network." Zhang Yong’s enthusiasm for the company is fading. Including himself, a word that MIUI engineers often talk about later is called "big market data"-always remember the real characteristics of Xiaomi mobile phone users and the corresponding user needs-and finally the products that they keep iterating in their hands are becoming more and more "headline-oriented" in content selection, in exchange for higher user stickiness and greater traffic. The final value of these efforts is to convert them into more advertising revenue.

Xiaomi asked Nielsen, a data research company, to complete a customized user experience report. When the report was placed on Lei Jun’s desk, he realized the seriousness of the problem.

Lei Jun spent a lot of money to restore the confidence of users. He asked the next MIUI9 to solve the core task, which is to let users re-realize that Xiaomi mobile phone is "as fast as lightning". To this end, "(advertising) can be cut first, and the manual switch is set for the advertising space that cannot be cut."

At the Xiaomi Note 2 mobile phone conference in October 2016, taking advantage of most Xiaomi employees, Lei Jun suddenly released Xiaomi’s first full-screen concept mobile phone, Xiaomi MIX, at the end of the conference.

Xiaomi has spent two years on the research and development of this mobile phone. It uses a ceramic body to prepare for wireless charging and the arrival of the 5G era. More importantly, Xiaomi became the first mobile phone company in the world to make a 17: 9 screen at that time. In Lei Jun’s words, the advent of MIX was the result of Xiaomi’s "development at no cost", and when the first batch of MIX mobile phones were mass-produced, the yield was less than 10%, which meant that the cost of each mobile phone was equivalent to 10 mobile phones.

Zhang Yong experienced this scene, and that moment really made him feel a little bit when he became a "rice noodle". "It’s the kind of feeling that really makes you forever young and always in tears. At that time, after reading the introduction of Note 2 in the audience, I took a meal first, and then the PPT flashed, my God. " Zhang Yong knows that after Zhou Guangping was persuaded to retreat, Lei Jun personally took the Xiaomi mobile phone team all the way to support it, just for the arrival of this moment-"In order to let all rice noodles see the Xiaomi who once met the Buddha and killed the Buddha and only pursued technology." "

The release of MIX is an important encouragement to the morale of Xiaomi team.

In June 2017, when the refreshing mobile phone system MIUI9 was released, Zhang Yong’s confidence in the company was once again enhanced. However, that fundamental contradiction has not been solved. "In this version of MIUI10, the advertising space that came back has all come back." The Internet service represented by MIUI department is still Xiaomi’s greatest hope to achieve overall profit-although the revenue ratio is not high, its gross profit margin can currently exceed 60%, while the gross profit margin of smartphones is only about 6% to 8%, and the gross profit margin of IoT and consumer products is also not high, at around 10%.

This temptation is implied in the business model of "small profits but quick turnover" put forward by Lei Jun in 2010: first enlarge the scale of hardware users, and then get more profits from the Internet service level.

Facts have proved that this model is a bit idealistic.

# Xiaomi New Retail: Sales Volume, Sales Volume, Sales Volume #

Since Xiaomi decided to open an offline store, its first step was to transform and upgrade Xiaomi Home, which only undertook after-sales service before.

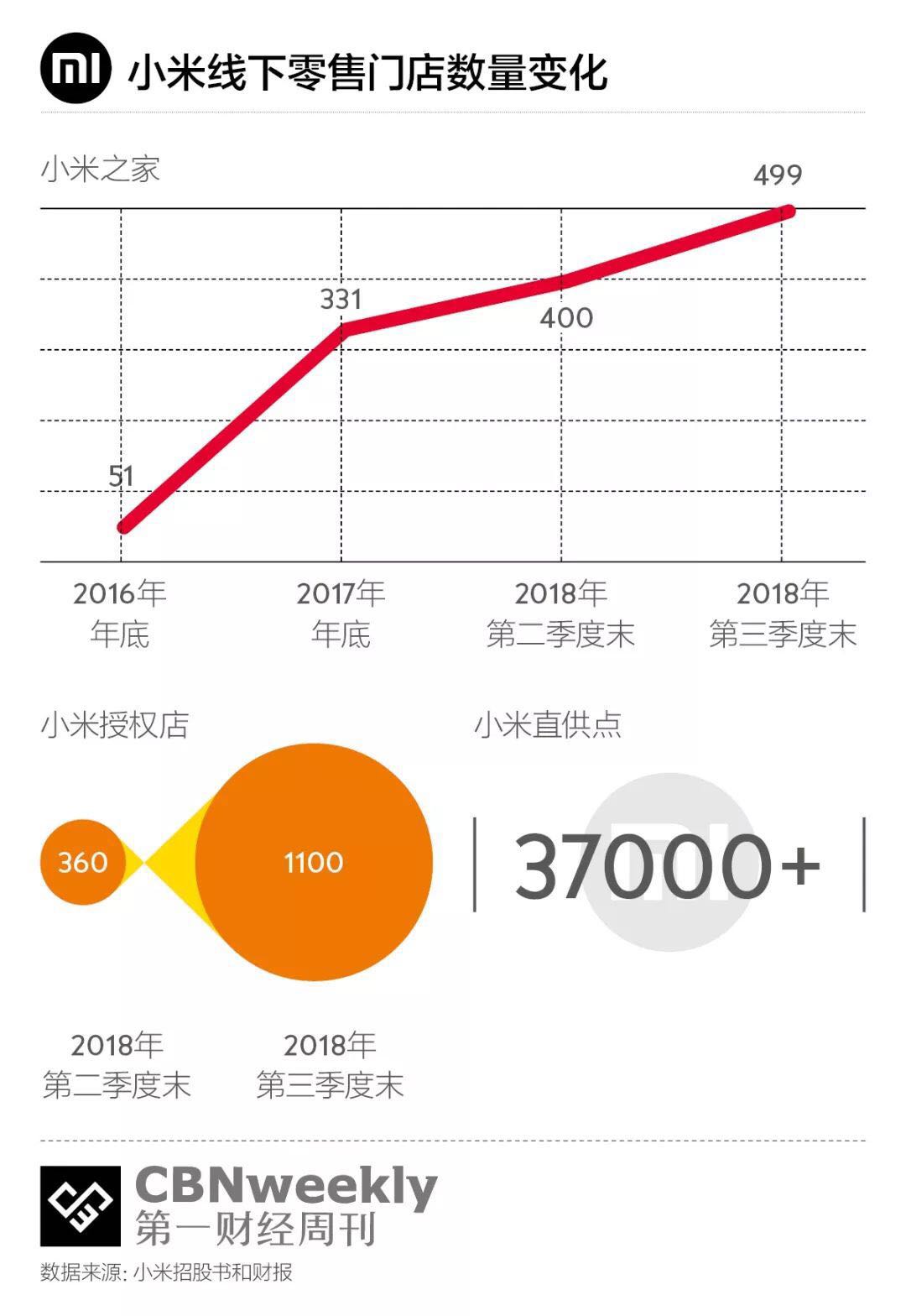

Lei Jun has publicly stated that it is actually "too late to start" to really transform Xiaomi House in 2016. At the end of 2016, there were only 51 "Xiaomi Home" stores that were given retail functions again. Then in just two years, the number of stores expanded to 499-almost twice that of MUJI, which started to open stores in China in 2008.

In order to further complete the sinking to the lower-end market, in addition to the store model of Xiaomi House, Xiaomi successively launched two forms of stores: "Xiaomi Authorized Experience Store" and "Xiaomi Store" in 2016. The relationship between these three stores is that the closer to the county and township, the greater the difference between the appearance of the latter two stores and the flagship store of Xiaomi House.

In the latest quarterly report, Xiaomi took the initiative to mention a "great leap forward" in its new retail business-it opened 740 "authorized experience stores" in 90 days, increasing the total number of offline stores in this format to 1,100, covering 563 counties across the country, and this number should be at least doubled in the future.

More subtly, the term "Xiaomi Store" gradually disappeared in Xiaomi’s public relations communication. Its iterative name is "Xiaomi franchise store" or "direct supply point". The number of such stores has now exceeded 37,000, and their task is to further sink Xiaomi’s channel network to tens of thousands of towns and villages across the country.

On October 1, 2018, in Wuhan, Hubei Province, the flagship store of Xiaomi Home, located in Chuhehan Street, the most famous local commercial street, opened. This flagship store, which has three floors and is by far the largest in China, sells all kinds of goods, such as mobile phones, computers, rice cookers, electric toothbrushes and even towels, and the minimum inventory units (SKUs) except mobile phones add up to more than 700. Besides, this is just a mobile phone shop, which is completely inappropriate. It looks like IKEA-there are even model rooms in the store.

Lei Jun’s ideal model for offline stores is MUJI: the product category structure is diversified, the product design and display methods are extremely simple, the location tends to be shopping centers, and the sales model, he also hopes to "cut off the middlemen" and run the store himself like MUJI.

These practices are different from the traditional offline distribution model of mobile phones. Take OPPO and vivo, which mainly gain market share offline, as an example. Both companies pursue a three-level agency model from "national generation" to "provincial generation" and then to "county generation". "Sometimes there will be more levels." A retired employee of vivo told China Business News that those agents usually open their stores in the streets where mobile phone brands gather, and the goods in the stores are basically mobile phones.

Diversified commodity structure and location strategy make Xiaomi House look more attractive than offline stores of OPPO or vivo, but its market coverage is limited. Xiaomi originally hoped to sink into more third-and fourth-tier markets with weak online shopping habits through this model. However, according to its third-quarter financial report just released, Xiaomi’s 499 Xiaomi homes in mainland China are mainly distributed in first-and second-tier cities. According to the news provided by Xiaomi’s public relations department to CBN Weekly, Xiaomi will not increase the number of such stores in the future.

This makes the actual number of Xiaomi homes only half of Lei Jun’s original goal. In February 2017, at the Yabuli Forum, Lei Jun proposed to open 1,000 millet homes within three years. At present, a large part of Xiaomi House which has been opened is actually invested by franchisees. Xiaomi official never disclosed the ratio of this model to the fully self-operated Xiaomi House, but Sun Yanbiao, president of the First Mobile Phone Research Institute, told CBN Weekly that Xiaomi only kept a few model stores in some cities for self-operation, while others were funded by franchisees, and Xiaomi sent teams to operate. According to the data he provided, each franchisee has to spend at least 1 million yuan to join a store.

When the "Xiaomi Xiaodian" project was first established in 2016, Xiaomi expected to join this cause with its hundreds of millions of rice noodles. Xiaomi store has set a very low threshold for franchisees, and even a college student without any savings or stores can open a Xiaomi store. But the people who really joined this business later were not the "ideal candidates" for Xiaomi, or rice noodles.

Xinzhou District, 40km away from downtown Wuhan, is a county town with a resident population of only about 200,000. Xie Wendong, who lives there, was the first franchisee to come into contact with Xiaomi Store. Before, he had a shop of about 80 square meters in the local pedestrian street, mainly selling LeTV. Considering that the introduction of millet products might bring new passengers to the store, he registered and applied for a Xiaomi shop to try.

The process of opening a store is relatively smooth. Xie Wendong said, "Just scan a QR code and there are dozens of questions to see if you agree with the brand concept. If you get 80 points or more, you will pass, which is particularly simple." After that, he received an account, which was used to log in to Xiaomi Store’s website to purchase goods in the background.

Xie Wendong selected more than 80 products at first, but so far all he sells in his shop are Xiao Ai speakers, several Xiaomi TVs, and more than 20 products that don’t take up much space, such as towels, rainbow batteries and signature pens. These products can bring him passengers, but "from the point of view of our businessmen’s pursuit of maximizing profits, it’s really unprofitable." Xie Wendong said that he compared the LeTV products he had operated with OPPO and vivo, which have 30% gross profit space across the street.

Unlike other mobile phone brands, which get goods directly according to the price of secondary or tertiary channels, Xiaomi’s next store adopts a rebate mode-Xie Wendong first gets the goods in full according to the price in the background, and the price is the retail guide price marked online at that time, and only after the goods are sold can he get the "income" next month. He showed reporters the background operating system of Xiaomi Store. Clicking on a mobile phone with a retail price of 999 yuan at will pop up and tell the merchant that the profit is 180 yuan, and the profit from selling a rice cooker at a price of 999 yuan is 149 yuan. It seems that this "rebate" is not low, but Xie Wendong still shouts that he will not make money-the problem is that Xiaomi has no "guaranteed price" strategy for small stores.

"I sell 999 yuan for a mobile phone, but at the same time JD.COM may only sell 699 yuan for activities. I can only take the initiative to reduce the price myself. So even if Xiaomi returns to 180 yuan, in the end, we actually don’t make money at all. " Xie Wendong said. At the same time, the franchisee of Xiaomi Store is not optimistic about the penetration of Xiaomi in low-tier cities-in Xinzhou, a county town with a per capita monthly income of 2,000 yuan, it is still unrealistic for a family to accept new things like IoT. Some of his customers will buy 299 yuan small love speakers because they are fresh and fun, but after a month or two, they will become idle products at home.

Xiaomi’s idea of selling mobile phones by rice flour is good. After all, only people who understand Xiaomi and believe in Xiaomi’s brand concept can better complete the sales of goods through word-of-mouth marketing, but Xie Wendong is not such rice flour. Sometimes, for business reasons, he will "operate" more. For example, when JD.COM reduces the price, he will get the goods from JD.COM, or open a shop on Taobao, and sell the inventory in the shop to customers far away in Jiangsu and Zhejiang. Some real estate developers there like to get the goods from him best, and they can either invoice or negotiate the price. Later, Xiaomi official also deliberately played down the active spread of Xiaomi store.

Qin Fuyong is also a Xiaomi franchisee in Wuhan. Unlike Xie Wendong, he has bid farewell to the primary store model of Xiaomi Store and has a Xiaomi authorized experience store.

Qin Fuyong is optimistic about Xiaomi. "Although the profit margin is small, the volume is large and the efficiency can be high." He told China Business News that the practice of OPPO and vivo would become less and less attractive to him.

Qin Fuyong actually "promoted" from Xiaomi store to authorized store. His performance during the Xiaomi store was not bad, which attracted the attention of the store management team under Xiaomi. In August this year, Xiaomi Company sent a provincial manager to visit his store several times, and took the initiative to upgrade Qin Fuyong’s direct supply point to Xiaomi authorized store. The authorized store model enjoys the "guaranteed price" policy-when the online price is lower than the delivery price, Qin Fuyong can sell at the online price, and the company will subsidize the difference together.

However, if you want to become an authorized store, you need to act as an agent for franchisees to purchase goods worth 400,000 yuan at one time. Moreover, although Qin Fuyong thinks that Xiaomi’s "new retail" is more promising, he feels at a loss in the specific store operation. "I don’t know how to do it. I didn’t think about it. Maybe Xiaomi didn’t think too well." What he doesn’t understand includes the whole set of business methods from commodity structure, in-store display, dynamic line design and marketing. How to do every link in the end is almost explored by Qin Fuyong himself. During the whole process of opening a store, Xiaomi’s store operators only provided a set of standardized solutions for store decoration for his reference.

If the business is good enough, Qin Fuyong intends to open more stores, but he is not very happy that the authorized store he has painstakingly managed has to assume the role of so-called "offline experience"-those customers who come to the store only look at it and don’t buy it, which is actually zero contribution to his business.

The "selling goods" at the level of authorized stores make the price of millet products in many areas chaotic, and the different store images also make it difficult for consumers to form brand awareness. However, these problems are not in Xiaomi’s task management list at present. Xiaomi’s goal at this stage is to open more shops run by agents. "At least there is no upper limit at present." After Xiaomi announced the third quarterly report, the above-mentioned Xiaomi public relations department told China Business News.

# "Eco-chain" company: users, users, users #

More than 200 Xiaomi "eco-chain" companies provide SKUs for Xiaomi’s offline stores.

Hans tung, managing partner of GGV ggv capital, first heard Lei Jun put forward the word "ecological chain" in September 2013. At that time, he attended the Global Mobile Internet Conference (GMIC) in Silicon Valley. Lei Jun and several people from Shun Wei Capital found him and told a story about Xiaomi’s upgrade.

"At that time, he mentioned that he wanted to be a Xiaomi ecological chain. We all thought this idea was very good, because Xiaomi already had a brand effect. Everyone was used to buying things in its App or Xiaomi Mall. If more products can be added, we think this model is worth exploring." Hans tung told China Business News.

According to Lei Jun’s idea, Xiaomi can create an ecological circle with the smart phone as the core, and a smart home circle and lifestyle consumables circle can also be constructed around the mobile phone. All the intelligent hardware in these products can be controlled by MIUI, which can not only expand the number of users on the Xiaomi market, but also play a role in draining the frequency of physical store-to-store-compared with towels or batteries, people may only change their mobile phones once a year or two.

Among all commodities, Xiaomi only designs and produces a few items such as mobile phones, televisions, routers and smart speakers to stay focused. Other intelligent hardware products such as mobile power supply, desk lamp, rice cooker and water purifier, or lifestyle products such as towels, batteries and electric toothbrushes are all handed over to the eco-chain company for operation. Xiaomi will "empower" these companies with its product concept, design capability, supply chain resources, sales channels and successful experience.

Most of the "eco-chain" companies attracted by Xiaomi and his investment team are startups. They take "a certain rice" as their brand name, and some of them don’t even have a formed company form when they receive investment. For example, Zimi, which produces mobile power supply, is the result of "proposition composition". Its founder, Zhang Feng, was originally the general manager of NVIDIA. After talking with Lei Jun and Liu Deshen, Zhang Feng accepted the proposal that the two founders of Xiaomi wanted him to set up a company to develop mobile power supply.

This model has great advantages at the beginning. Under the guidance of Xiaomi, some eco-chain companies quickly produced the first "explosive products".

On April 8, 2015, Huami bracelet, one of the most famous products in Xiaomi ecological chain, achieved a single-day sales of 208,000 pieces.

The first product released by TS Glasses with the help of Xiaomi platform is its nylon polarized sunglasses which participated in "Xiaomi Crowdfunding" in February 2017 and achieved 1130% completion. Two months later, it officially joined the Xiaomi ecological chain. "When Xiaomi has a meeting with us, he often reminds us to do the basic idea first, that is, you should do the’ single item explosion’ first, and don’t consider too many other things at first." Yan Jin, general manager of TS glasses, told CBN Weekly that Xiaomi’s biggest advice to eco-chain companies is that the first product must "break through", that is, it will quickly occupy the market through low prices, leaving competitors’ products with little room for survival.

According to Xiaomi’s product positioning suggestion, the first product of TS glasses is made into sunglasses without offline optometry, and the price is set at 199 yuan, because according to Xiaomi’s online business experience, "once the customer’s unit price exceeds 200 yuan, the sales volume will drop by 70%". In the procurement process, Xiaomi added TS glasses to the joint procurement list that needs to purchase silicone just like mobile phones and bracelets, which made this sunglasses match the suppliers of high-end competing products in the market from the beginning, and the cost was lower than the other party. Because of the sales platform provided by Xiaomi, the first production order, TS glasses opened the quantity to the order of 100,000 pairs.

Shenzhen Yunmi’s first water purifier is also such a process. It learns from Xiaomi to re-examine all links in the supply chain, cut off those parts that can be "cost down" and improve those designs with poor experience. In the end, it changed the assembled waterway in the traditional water purifier into an integrated waterway, which not only solved the problem of easy water leakage of the assembled waterway, but also reduced the injection cost through the large-scale procurement of Xiaomi platform. In the water purifier market with an average price of about 5,000 yuan, Yunmi manufactured a product with a price of 1,999 yuan for Xiaomi platform.

These companies and products began to prepare in 2013. When Xiaomi House opened its offline store in 2016, goods were available for sale immediately. After that, it is difficult to empty the shelves of the store under the rice noodle.

But not all products are as easy to re-examine the cost and design as mobile phones. "Some products have natural inventory turnover problems, such as clothing, as well as seasonal and fashion trends. No matter how efficient I am, it is impossible to guarantee that it is like a fan (long-term sales), then its cost-effective gross profit margin must be greater than that of a fan." A founder of an eco-chain enterprise who did not want to disclose his identity told China Business News.

Even the little ants who produce cameras can’t do this. "We said that you should quickly penetrate the market with lower price and faster reaction speed, but the other party did not follow our logic, and its pricing was very expensive. In this case, it is equivalent to not breaking through. It should have sold two or three billion yuan a year, but now it is still hovering over hundreds of millions. " Liu De, co-founder of Xiaomi, who was in charge of the eco-chain business, said in an interview with China Business News in November 2016.

According to the investment agreement, Xiaomi will customize some products in these companies by means of project establishment, and the relevant person in charge of Xiaomi’s eco-chain products will participate in the project establishment. If they are products of eco-chain companies’ own brands, they will have more autonomy. That is to say, if you choose to sell in Xiaomi channel and make "Mijia" branded products, you should follow Xiaomi’s 5% profit margin setting. Products that are not sold through Xiaomi channel need to set up another brand. Eco-chain companies can freely set prices, but in principle, they should still be consistent with Xiaomi’s values of "low profit margin", at least there should be obvious differences in profit margin with products of the same quality in the same industry.

With this "right", these companies almost unanimously chose to set up their own brands with high-end positioning and higher profit margins outside Xiaomi platform. The manager of Yunmi Guangzhou Zhengjia Plaza Store told CBN Weekly that Yunmi developed a water purifier with a price of 4,999 yuan in addition to the 1,999 yuan water purifier customized by Xiaomi. The two products use similar water purification technology, but different materials are used in the fuselage consumables and carbon core and other water purification consumables-in fact, this is a return to the traditional mode of marketing-driven and relying on layer-by-layer agents to enhance market share.

"We feel that (ecological chain) must be good for Xiaomi, and whether it is good for Xiaomi Ecological Chain Company depends on their own nature." Hans tung said. Ggv capital finally invested in four Xiaomi Eco-chain companies, including Pure Rice, Smart Rice, Purple Rice and Jiayi Lianchuang, which make rice cookers, humidifiers, mobile power supplies and headphones respectively. Of these four companies, only Zimi has extended its business from mobile power supply to "battery expert", and other companies have not jumped out of the "single product victory" stage.

The supply chain built by Xiaomi from the beginning of investment to the shelf of products is bigger and more difficult to manage effectively than it originally imagined, but it is a step that Xiaomi has to take.

Eco-chain companies provide diversified hardware, which is just connected with Xiaomi’s "offline store" strategy. Their common goal is to help Xiaomi continue to expand the number of users. If these products have the attribute of "artificial intelligence", they will eventually be in the Internet service level. Let Xiaomi and Eco-chain companies get more room to realize.

# Self-help and the future #

After the large-scale expansion of offline channels and investment in eco-chain companies, Xiaomi’s mobile phone sales, total revenue and user base all rebounded or improved in 2017.

Xiaomi’s financial report in the third quarter of this year showed that the monthly active users of MIUI system exceeded 224 million. Through the sales of eco-chain products, Xiaomi has won more new customers of non-Xiaomi mobile phone users. According to the latest data in the third quarterly report, there are about 132 million devices (excluding mobile phones and laptops) connected to Xiaomi IoT platform, and the monthly active users of AI intelligent voice assistant "Little Love Classmate" as the center of a new generation of IoT are more than 34 million. In addition to users of Xiaomi mobile phones, a large proportion of these people are iOS users.

In terms of real value, these new users are more users who contribute "activated devices" to Xiaomi. In the future, these activated devices may be able to string together more complete behavior data of users. But the time it takes is unpredictable. "Due to multi-category, multi-modality and even cross-industry reasons, the IoT side needs mobile phone companies to have strong resource integration, standard collaboration, investment layout and long-term investment capabilities while increasing the market share of mobile phones, in order to achieve market position in the IoT field." Gao Bin, director of communication and technology research at Nielsen, said.

Even if the profit of Internet service level is still a relatively distant dream, Xiaomi has now exchanged income from the "new retail" section of his business model by providing sales platform services for these eco-chain enterprises. An operator of Mijia App revealed to CBN Weekly that half of the gross profit of the eco-chain products sold by Xiaomi’s own channels belongs to Xiaomi. "Sometimes, for high projects, Xiaomi can still make 60% of the gross profit.". Xiaomi is still an absolutely strong Party A in this cooperation.

It seems that the company is getting back on track. But Zhang Yong’s confidence in the company didn’t come back. "My boss continues to tell me how many hundred million yuan the revenue task of the whole project team is, and how much my group should share … In short, we are talking about numbers." Zhang Yong said, the title is OKR.

Lei Jun is actually well aware of the problems facing the company. After completing the listing on the Hong Kong Stock Exchange on July 9, Lei Jun began to carry out management changes to the company, with the purpose of operating Xiaomi’s various Internet businesses more finely and ensuring a balance between commercialization and user experience.

First, on July 23rd, Xiaomi appointed Yan Kesheng, former vice president of the mobile phone department, as the vice president of the group and concurrently served as the chairman of the quality committee of the group. Yan Kesheng is Xiaomi’s No.53 employee. He is internally evaluated as "very straightforward" and previously worked in Motorola’s mobile phone research and development department. The new appointment will expand Yan Kesheng’s authority from the quality management of hardware such as mobile phones to the user experience at the Internet service level. This role is said to be "and while one man guards it", whose duty is to try to reduce the erosion and harm of Xiaomi’s commercialization to the user experience.

Then, on September 22nd, Xiaomi announced "the biggest organizational structure change since the establishment of the company": the organization department and the staff department of the group were newly established, and the original MIUI department and the mutual entertainment department were split into four Internet business departments, focusing on MIUI experience, application stores, information, videos, etc. MIUI Experience Department no longer undertakes the responsibility of realizing the Internet, but is only responsible for "doing things right". Applications stores, information, videos and other businesses involving the realization of the Internet directly report to Lei Jun..

Before leaving his job, Zhang Yong knew that Xiaomi had to make greater structural adjustments to MIUI. The preliminary brewing of this adjustment began even in the first half of this year. He agrees that this round of reform is Xiaomi’s hope, at least the general direction is right. "In the past, the internal roots were intertwined, but now it has finally loosened, and the business line will become clearer." But in the end he chose to leave. "Some problems can’t be solved by changes at the architectural level." Zhang Yong said.

Chen Yanning, who only joined Xiaomi in 2017, also expressed the confusion of the so-called participants like Zhang Yong. "The mobile phone itself is not profitable, and the sales (retail channels) are not very high, then MIUI becomes a profit center." He told China Business News.

Both Chen Yanyu and Zhang Yong think that if we give them a better environment for product research and development, so that they can bear less pressure of commercialization, focus more on making the product itself better, develop products with more long-term value, and even make more explosive applications that are welcomed by users all over the network, Xiaomi’s imagination of "realizing the Internet" could have been larger.

In addition to MIUI system, Xiaomi has also developed many applications, such as reading software, instant messaging software Mi Chat, information software Xiaomi Info, and Xiaomi calculator, games, etc. Among them, Mi Chat was born earlier than WeChat, but among these applications, only Xiaomi calculator can be regarded as a cross-platform product. "First of all, you have to cross the defense between mobile phone manufacturers. Secondly, for example, to do information applications, you have to do it with the volume of today’s headlines. This Internet model can be successful." Chen Yanning said that the Internet application market is no less competitive than the mobile phone market.

Among the 200 million users of Xiaomi, nearly 70% hold Redmi series mobile phones with a unit price below 2,000 yuan, and most of them are men. They may be active payers of mobile games, but these users have limited willingness to pay for more potential content such as e-commerce, reading, film and television. Half a month ago, Xiaomi won the brand authorization of Meitu’s mobile phone business, also to increase some female users.

Xiaomi’s employees are envious of Apple’s healthier and more comfortable model. Under the premise of high gross profit of the hardware itself, in the environment of iOS, which naturally has a better payment order, the software layer can perform the mission of "continuously improving the user experience" with more peace of mind.

But Lei Jun never regarded Apple as Xiaomi’s benchmarking company. He is very diligent and thinks he has the ability to make a model according to his own understanding of the market.

Until he left Xiaomi, Zhang Yong said that he still agreed with Lei Jun’s ideas, and he didn’t feel that Lei Jun was insincere every time he talked about his ideals. In his view, the management problem exposed by Xiaomi at this stage is actually that the people above have a good idea. When it reaches the middle layer, there will always be some benefits delivery or personnel problems, which will lead to the final deformation in execution.

"This situation has become very serious since the listing of Xiaomi was put on the agenda. There are more and more internal things that can’t be said directly, you know and I know, but it just can’t be said directly. I don’t know why, it’s strange, for example, when something is not done well, you can’t say it directly. "

(At the request of the interviewee, Zhang Yong and Chen Yanyu are pseudonyms. )